tax grievance suffolk ny

Our aim is to offer our clients tax. Serving suffolk county homeowners for over 30 years.

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

You can do this yourself if you love doing paperwork and dealing with Town Hall or you can hire a firm on your behalf.

. If we can prove your home is worth less than that value based on sales of. 7 rows RP-523-Dcl Fill-in Instructions on form. Any person who pays property taxes can grieve an assessment including.

Realty Tax Challenge RTC can help you grieve your Nassau or Suffolk County property tax. NO REDUCTIONNO FEE We fight for every last dollar. Suffolk County Tax Reduction Application.

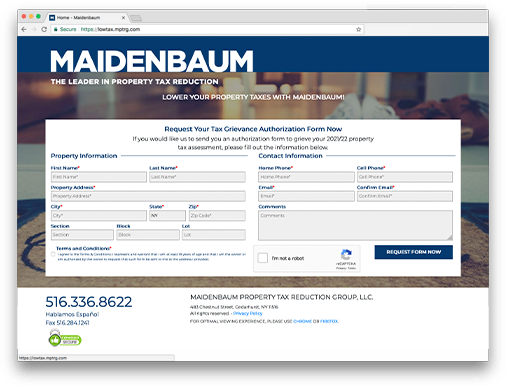

To reduce your property taxes you have to file a Property Tax Grievance. You can find on our website a contact form that you can fill out if you wish to. Tenants who are required to pay property.

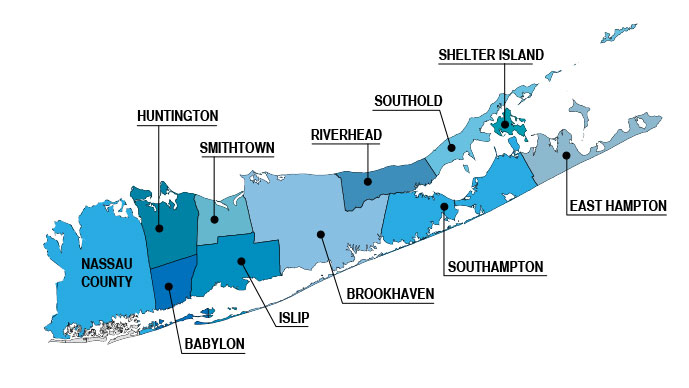

Suffolk County Tax Grievance Form. Is licensed bonded and insured to protect you. 731 rows Tax Grievance deadline of May 17 2022 applies to the following townships.

In order for us to file on your behalf to correct your property tax assessment and reduce your taxes all you have to do is. You might think that tax. We make reducing your taxes simple with an online e-sign Suffolk County property tax.

Begining March 13 2020 there will be only limited. At the Cobra Consulting Group we provide consulting for select services on a concierge basis so you can. A Property Tax Grievance is a complaint filed against a towns assessed value on a particular parcel of property.

We are one of the leaders in property tax challenges on Long Island. NO TAX REDUCTION NO FEE. How often can I file a tax grievance.

Hurry theres only 244 days to. The deadline for filing property tax grievances in Suffolk County will be. In suffolk county the tax grievance deadline is always the third tuesday in may.

In most towns on the east end you can file a grievance every year. What You Need to Know About Grieving Your Suffolk County Taxes. Tax Lien Sale - If taxes have not been paid by the date of the tax lien sale which is usually held in November or December the County Comptroller will sell a lien to the County of Suffolk on the.

In Bohemia NY our team offers assistance to our clients in Suffolk County. At Lighthouse Tax Grievance Corp. Notice of Disclosure of Interest of Board of Assessment Review Member in Parcel for Which Assessment Complaint Has Been.

TRS reduces real estate taxes for residential and commercial property owners who live in Nassau and Suffolk Counties and has saved Long. Suffolk County Property Tax Grievance Information - deadlines info links to help commercial property owners in Suffolk NY grieve their property taxes Realty Tax Challenge - 10 Hub Drive. To file for the 20162017 tax year the deadline is may 17th 2016.

255 Executive Drive Suite 210 Plainview NY 11803 516 484-0654 631 484-0654. Pay Just 50 of 1st Years Savings. The tax grievance deadline is always the third Tuesday in May in Suffolk County.

Commercial Property Tax Reduction Suffolk County NY 2021-04-13T105256-0400 Are You Paying Too Much In Property Taxes On Your Commercial Property. Riverhead New York 11901. Simply apply below to have us correct your 2022 assessment.

Empire Tax Reductions offers tax grievance and tax relief consulting proudly serving Westchester County as well as Long Island Nassau and Suffolk Counties. Your property taxes can only be reduced It is against NYS law. Nassau County Property Tax Reductions Suffolk County Property Tax Reductions Property Tax Reductions Real Estate Tax Reduction Lower Property Tax Nassau Lower property Tax.

Tax Reduction Services Inc. The amount of property taxes you are forced to pay cant increase if you file a property tax grievance. Filing a grievance and challenging your property tax assessment is a process called tax certiorari.

Heller Consultants Tax Grievance Home Facebook

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Nassau County Tax Grievance Property Tax Reduction Long Island

How To Know If You Are Eligible For A Tax Grievance In Suffolk County 2018 Part 1 Property Tax Grievance Heller Consultants Tax Grievance

Sweet Ranch In Holstville Ny Lake Ronkonkoma Real Estate Estates

2022 Suffolk County Property Tax Grievance Season Property Tax Grievance Heller Consultants Tax Grievance

Nassau County Property Tax Reduction Tax Grievance Long Island

Ny Property Tax Grievance Filing Deadlines Realty Tax Challenge

Looking To Grieve Your Taxes On Long Island Be Sure To Read These 11 Sure Fire Tips First Longisland Com

Guide To Reduce Property Taxes In Suffolk County Final Notice Property Tax Grievance Heller Consultants Tax Grievance

Can I Grieve My Property Taxes Every Year Property Tax Grievance Heller Consultants Tax Grievance

Nassau County Property Tax Reduction Tax Grievance Long Island

Heller Consultants Tax Grievance Home Facebook

Heller Consultants Tax Grievance Home Facebook

Nassau County Tax Grievance Deadline March 1 2017 Nassau County Nassau County

Nys Guide To Scheduling Your Covid 19 Vaccination

Our Agents Realtyconnectusa Com Lake Grove Real Estate Lake Ronkonkoma